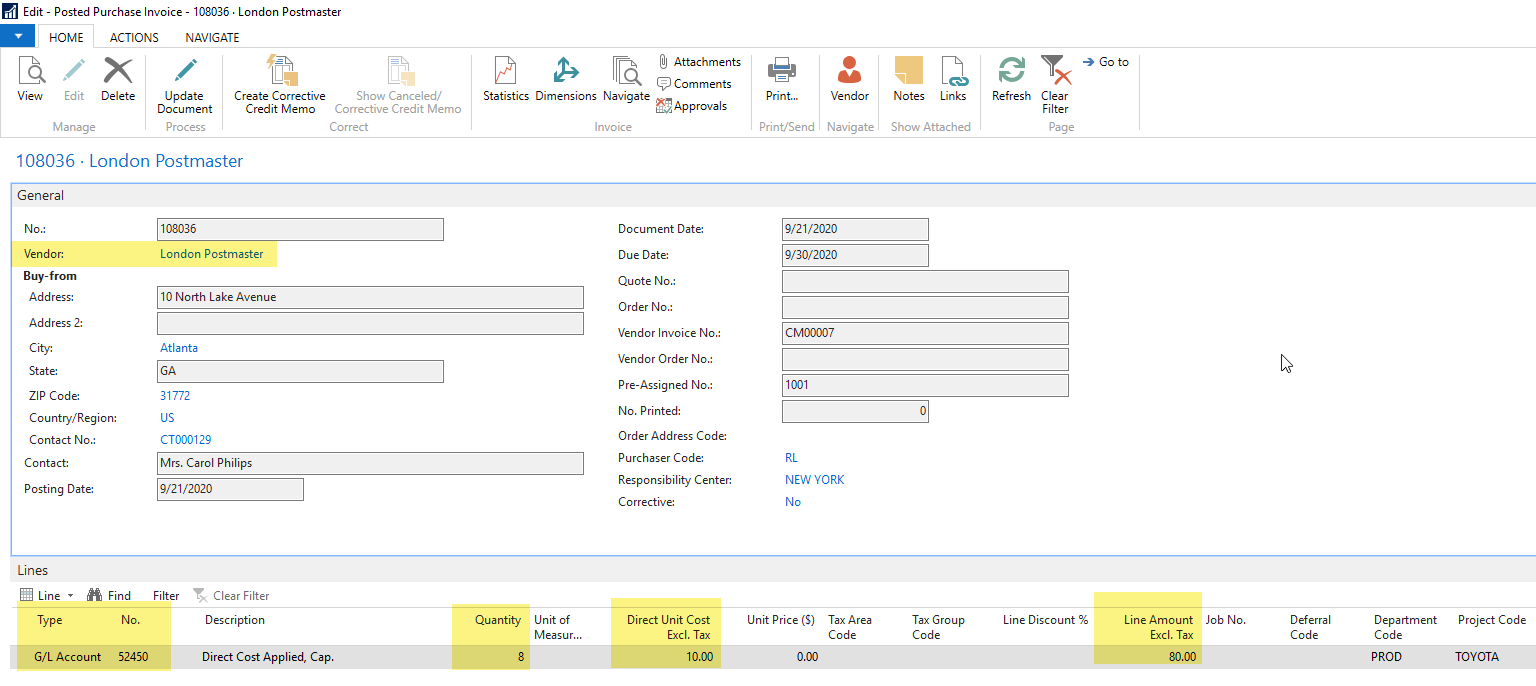

Solution Work flow

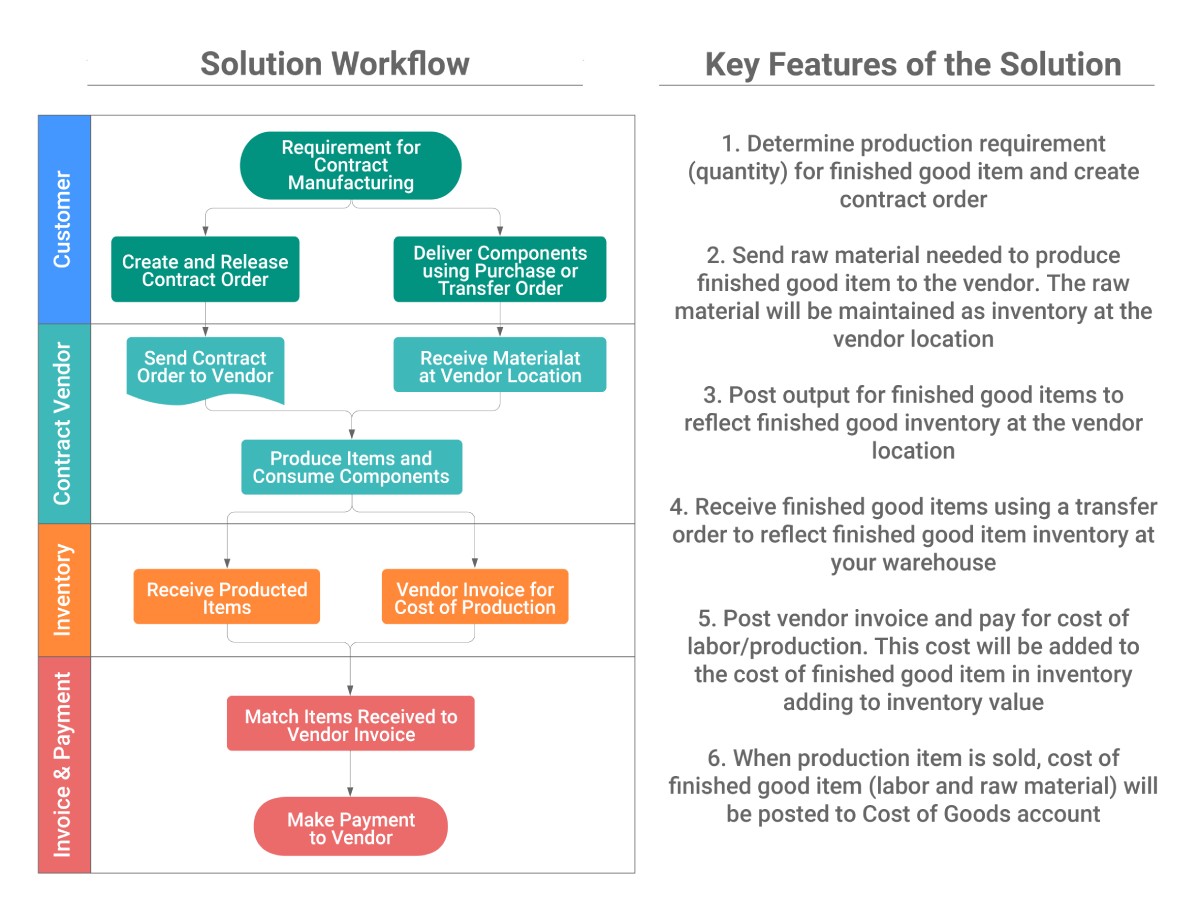

Define Contract Manufacturing Vendors. These are the vendors that the company is using to produce items.

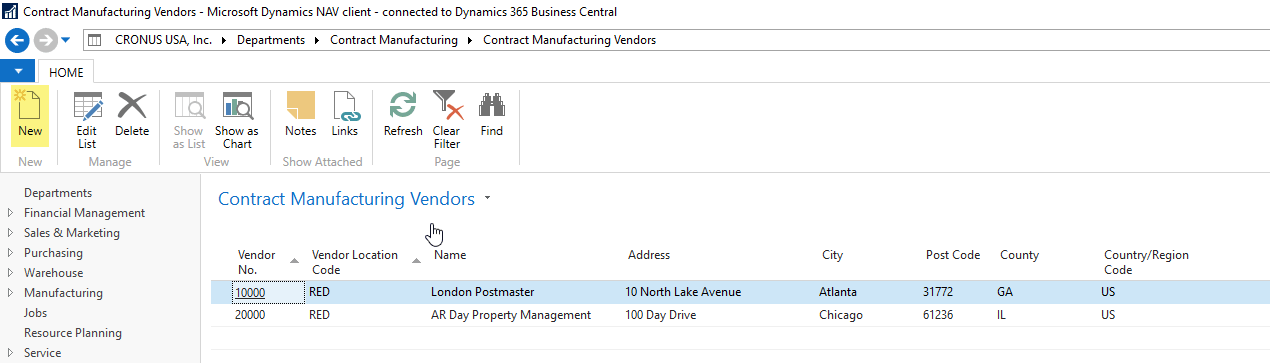

Define a location code, this the vendor location where raw materials (Components) will be sent.

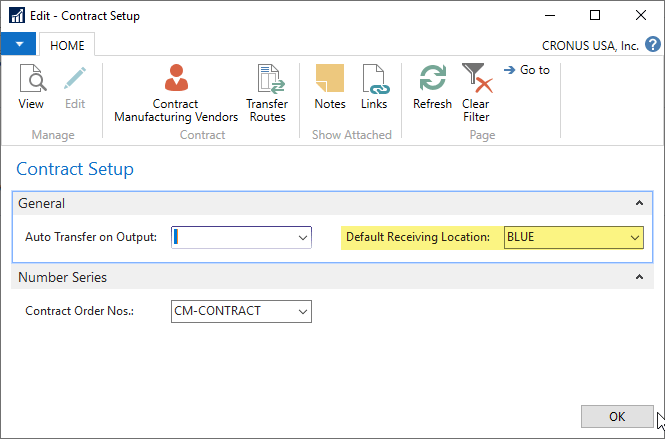

Define a default receiving location where produced items will be received.

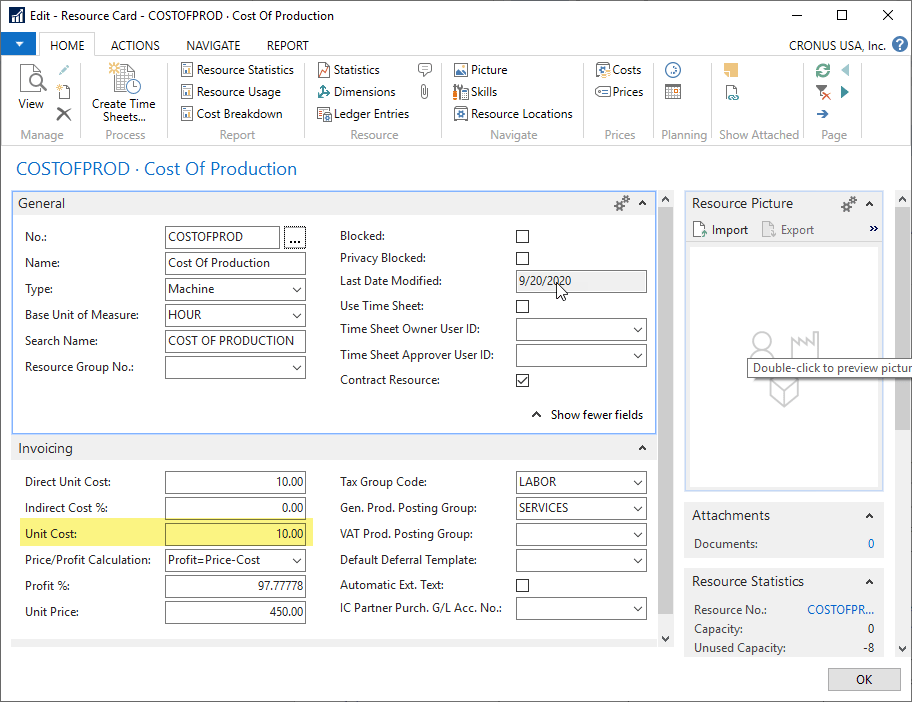

Define a resource for production cost.

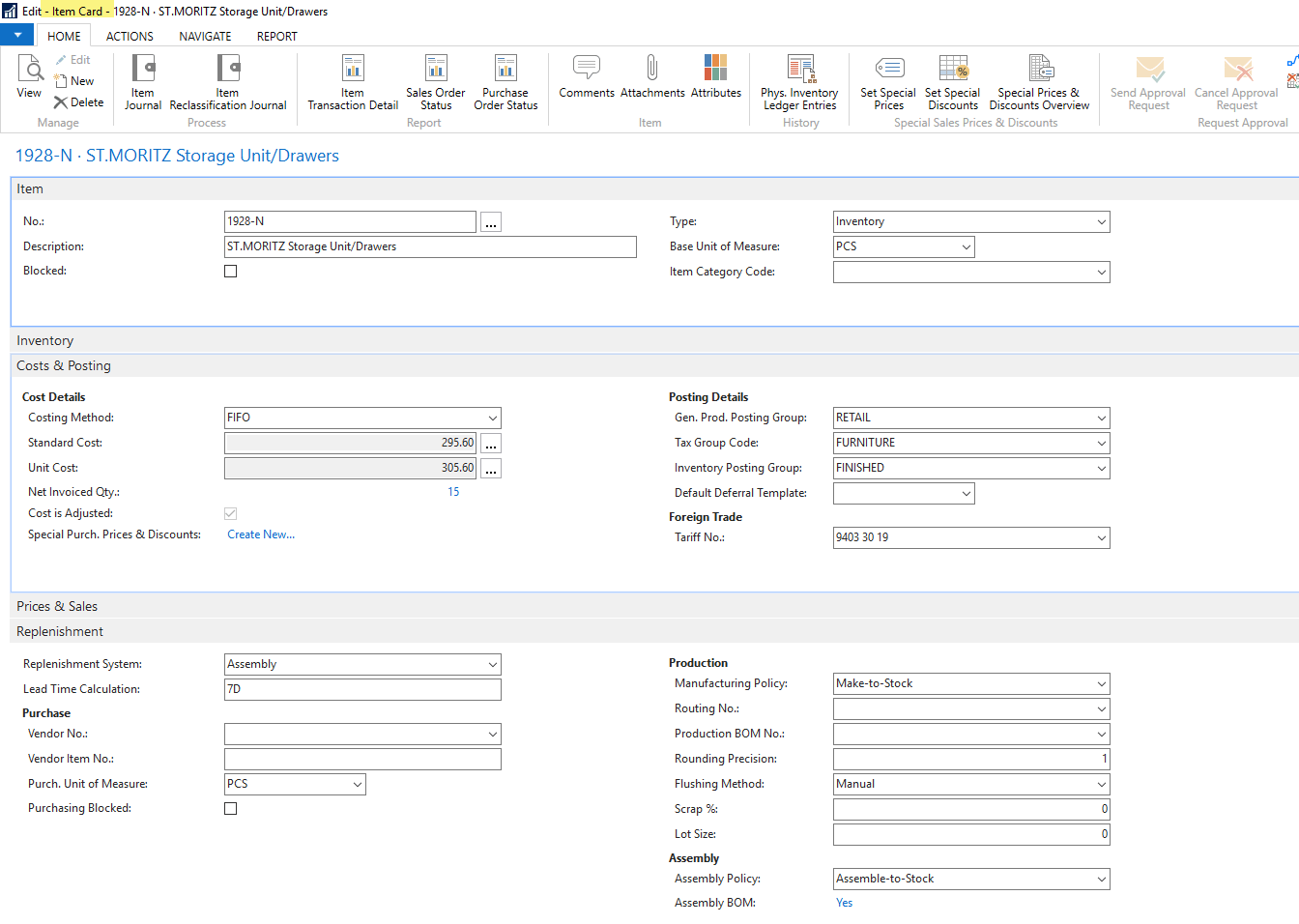

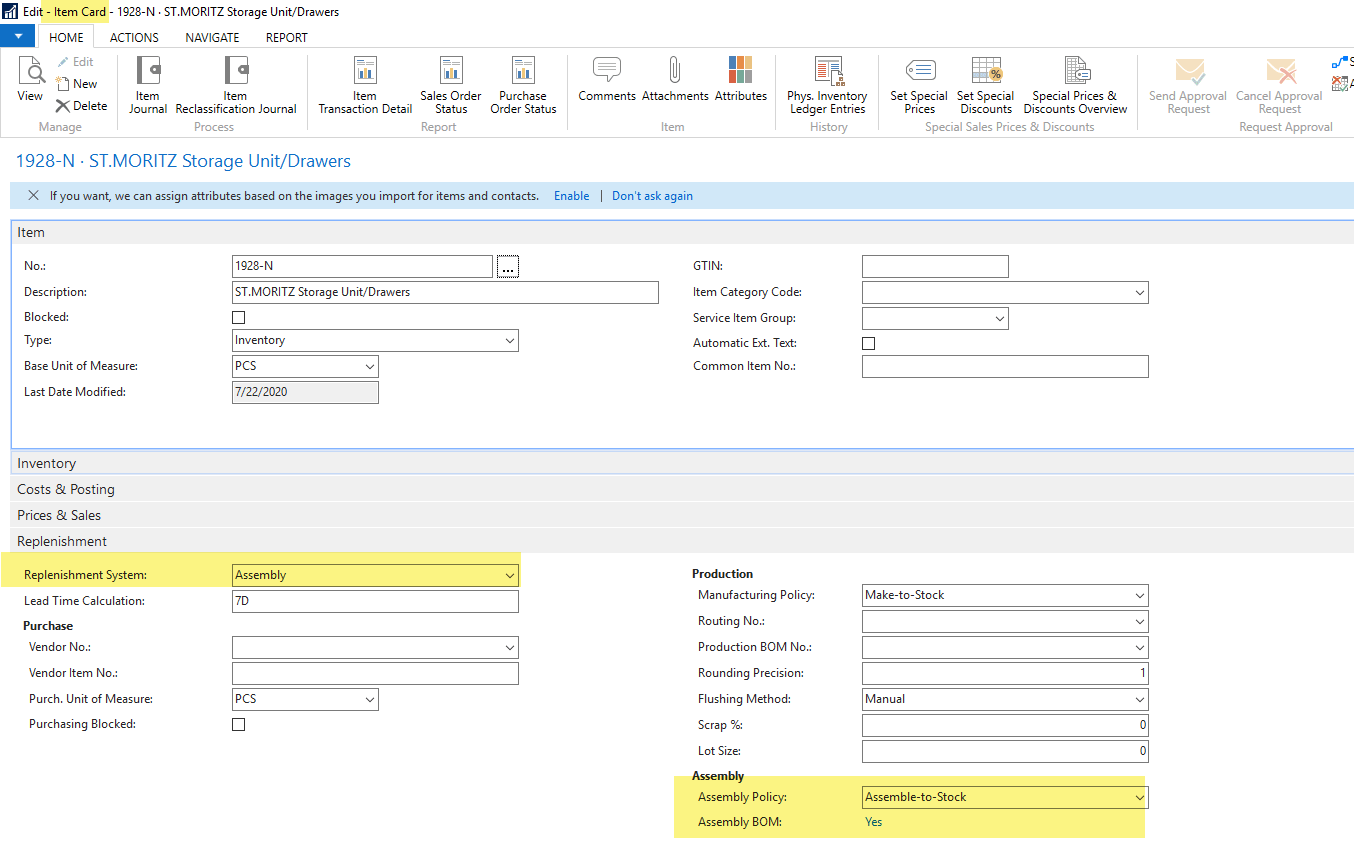

Create the finished assembly item that is going to be produced by the contract manufacturer.

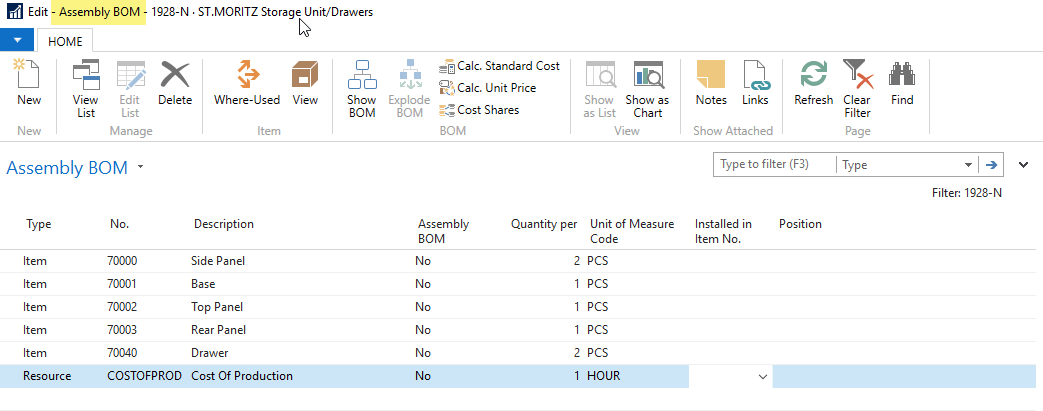

Define Item Assembly BOM. It can consist of Items and Resources.

Below is the Assembly BOM with components and resources needed to produce the item. The resource is used to specify per unit cost that the contract manufacture is charging to produce the items.

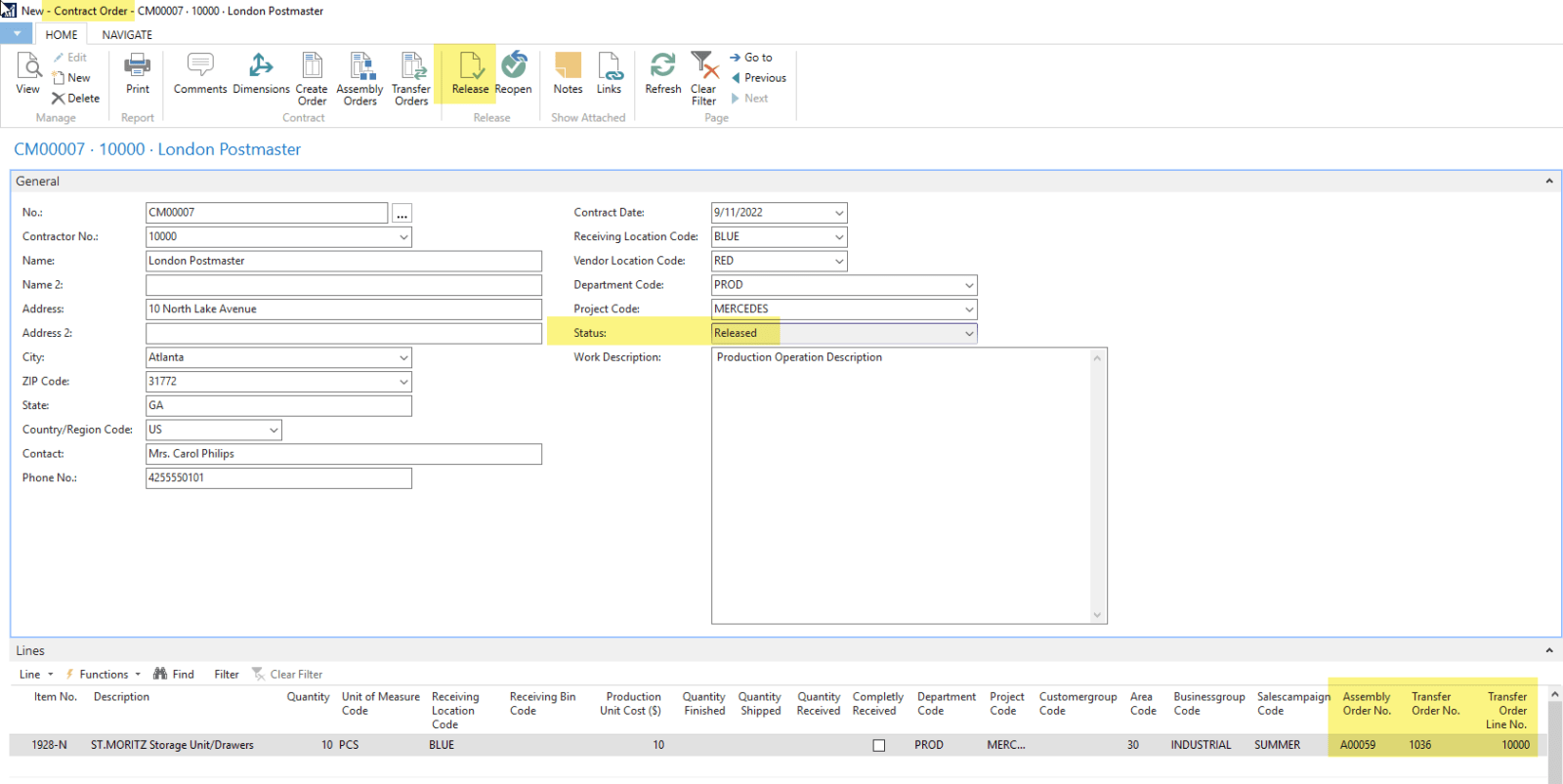

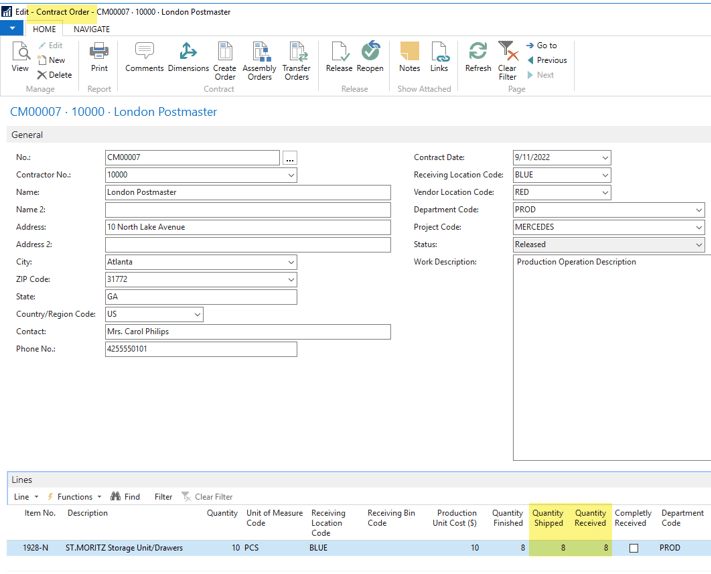

Create a Contract Order for the item and quantity to produce. Releasing the contract order will create a transfer order and an assembly order.

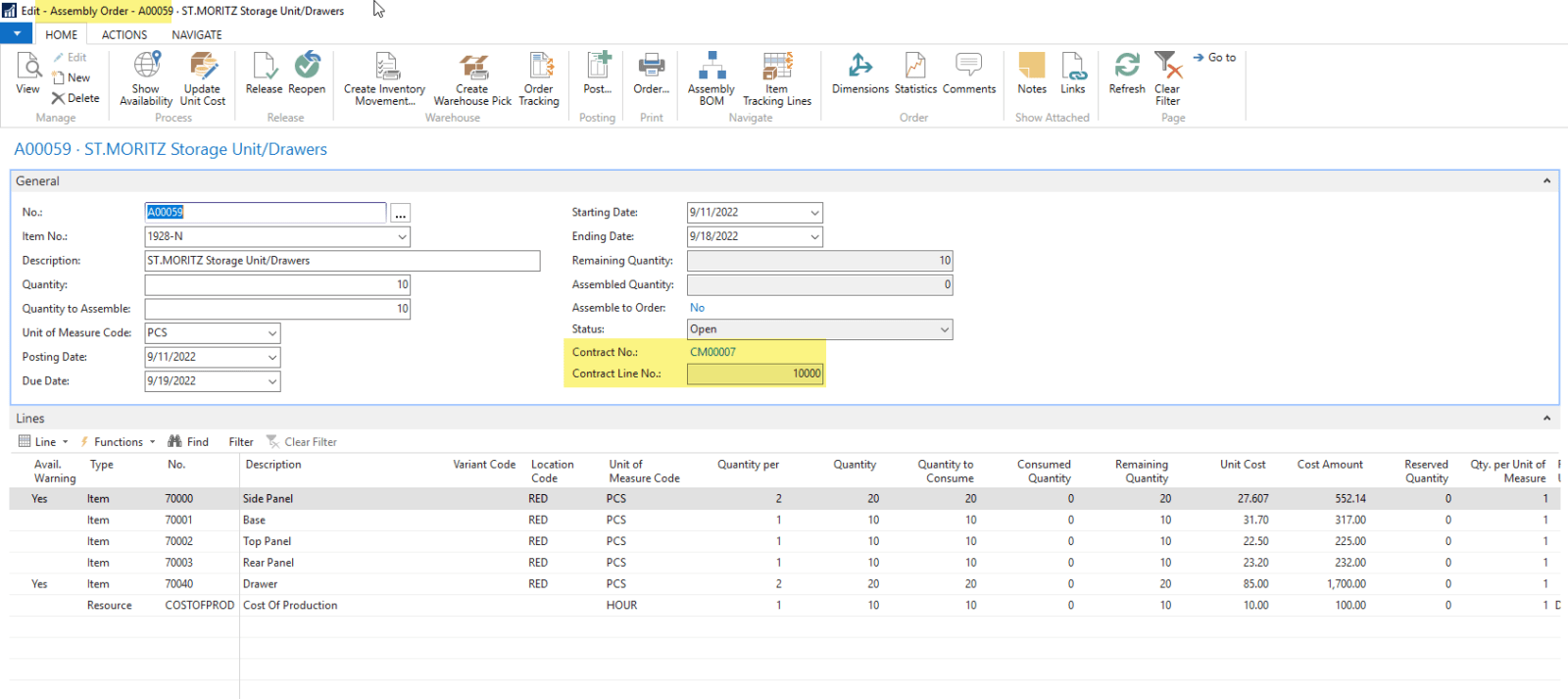

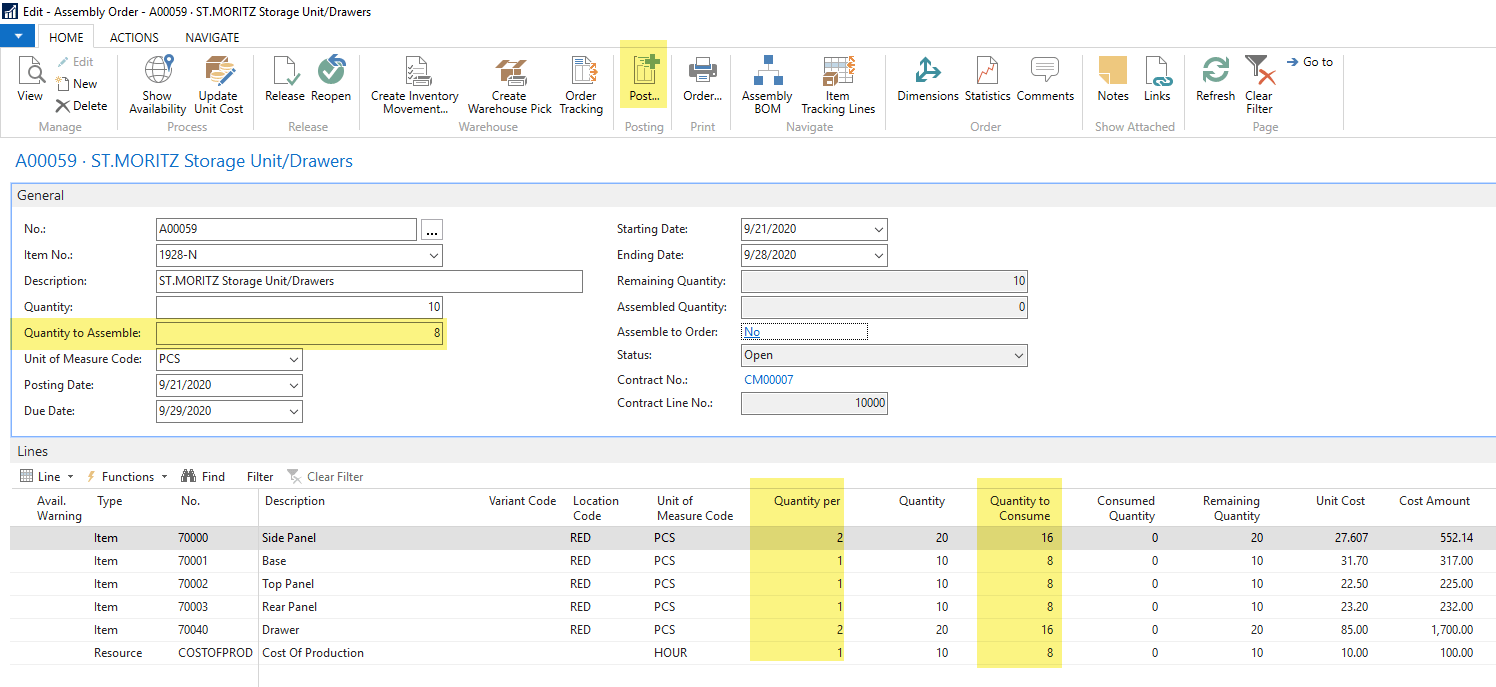

The assembly order created has a reference to the contract order number and contract line number

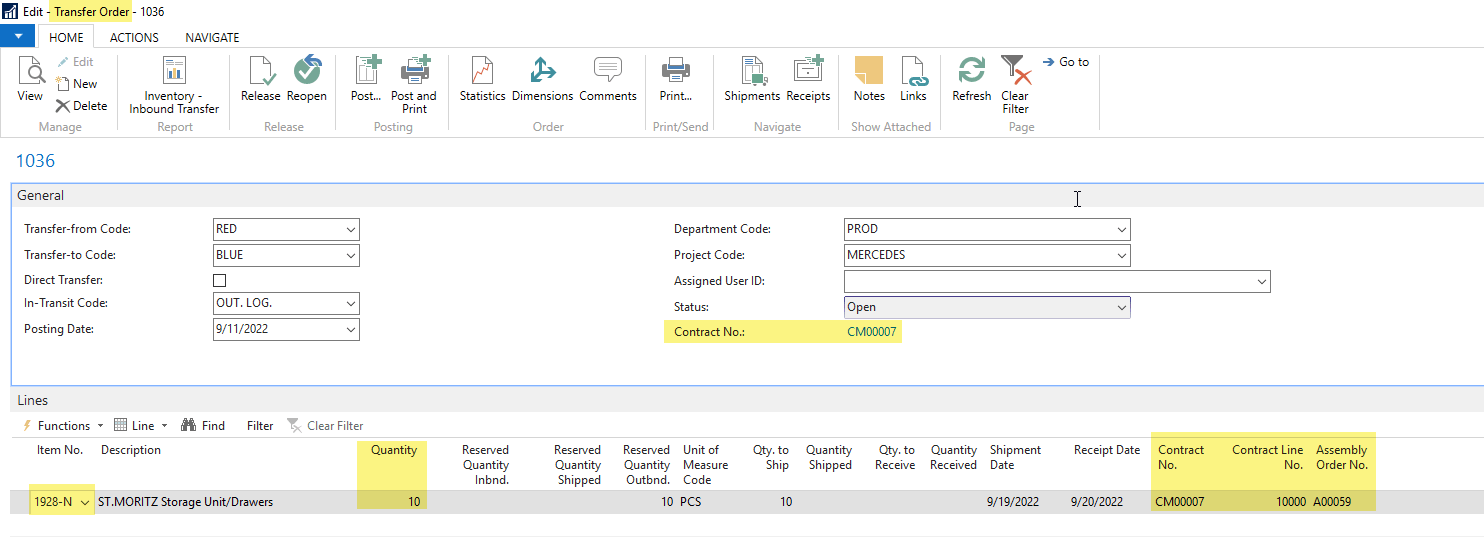

A transfer order has been created which will be used to transfer produced Items from the vendor location to the company location.

Raw Material can be transferred to the vendor location using a Transfer Order or a Purchase Order Drop shipment. Raw Material can be transferred for one contract at a time or in bulk for multiple contract orders.

In the example below, a transfer order is used to transfer raw material to the vendor location.

The transfer order is then posted (ship and receive) to transfer material to vendor location.

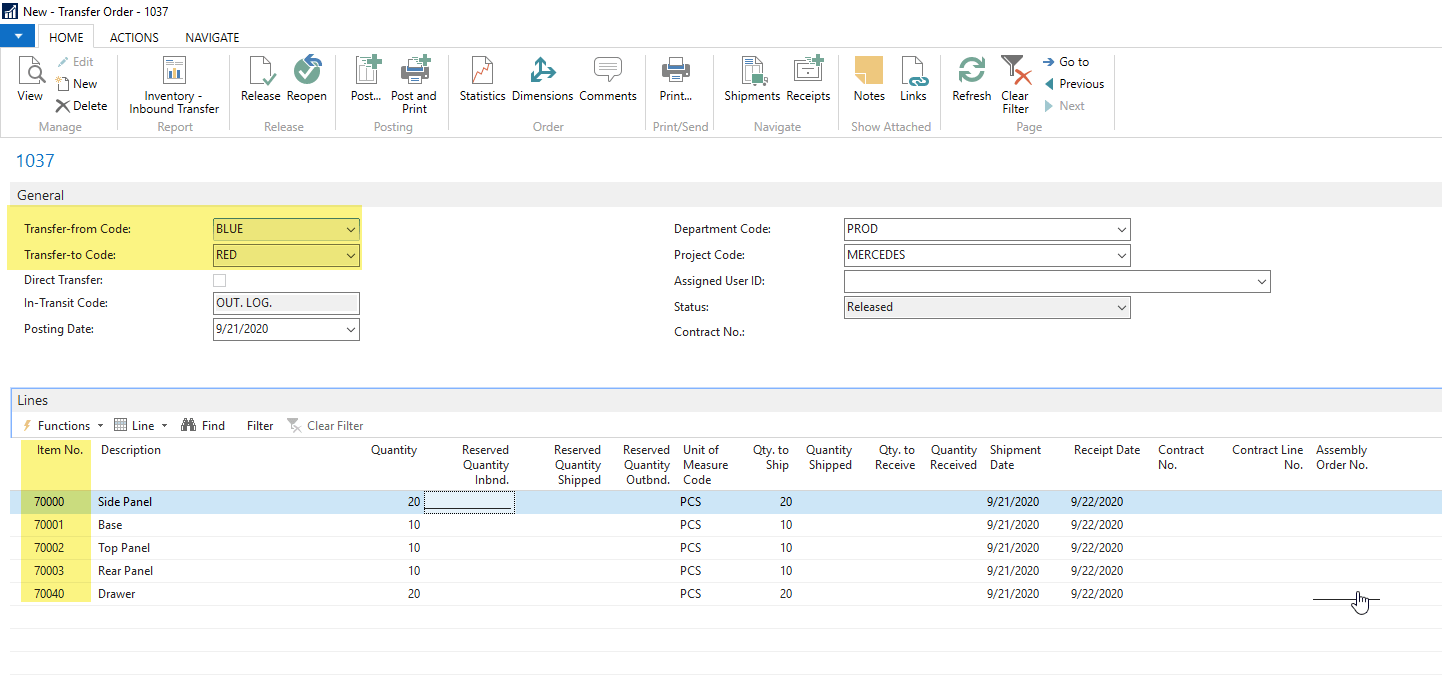

(7.1) Open Transfer Order

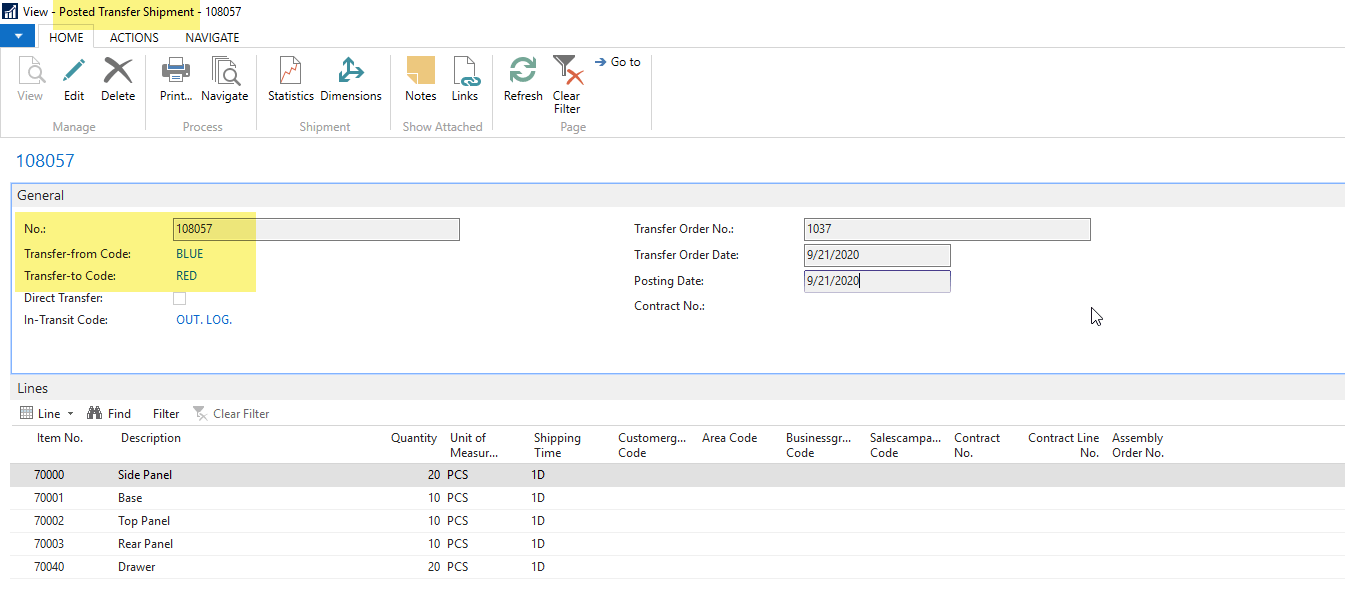

(7.2) Posted Transfer Shipment

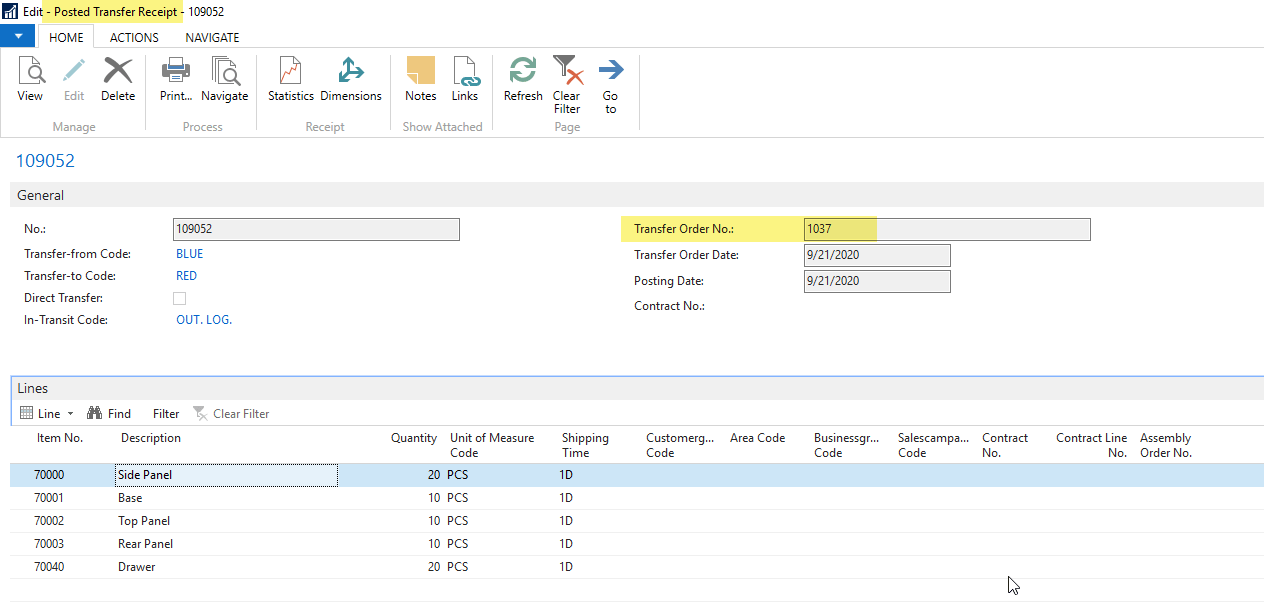

(7.3) Posted Transfer Receipt

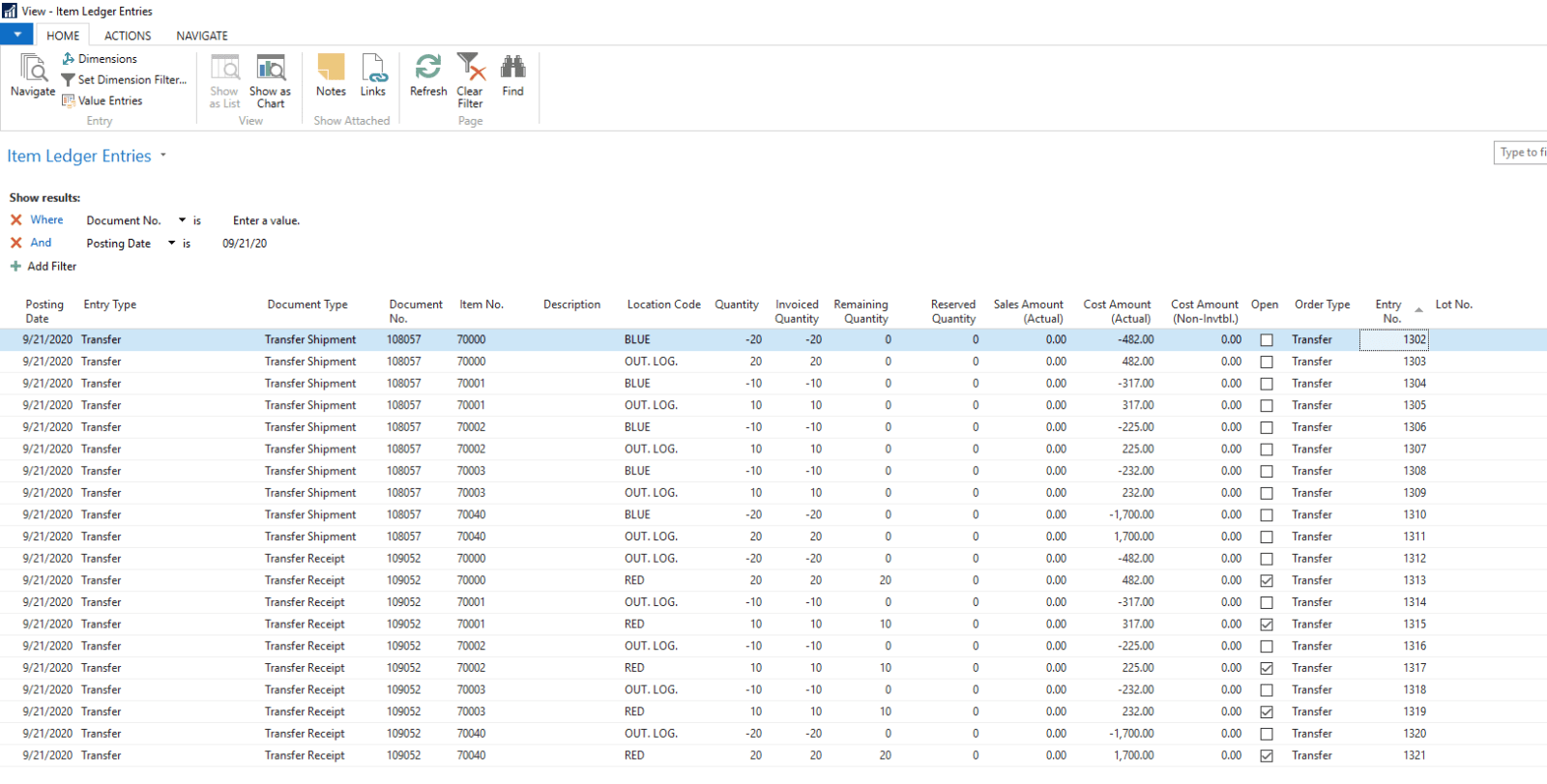

Below are the Item Ledger Entries showing transfer of raw material from the company’s inventory location to the vendor location.

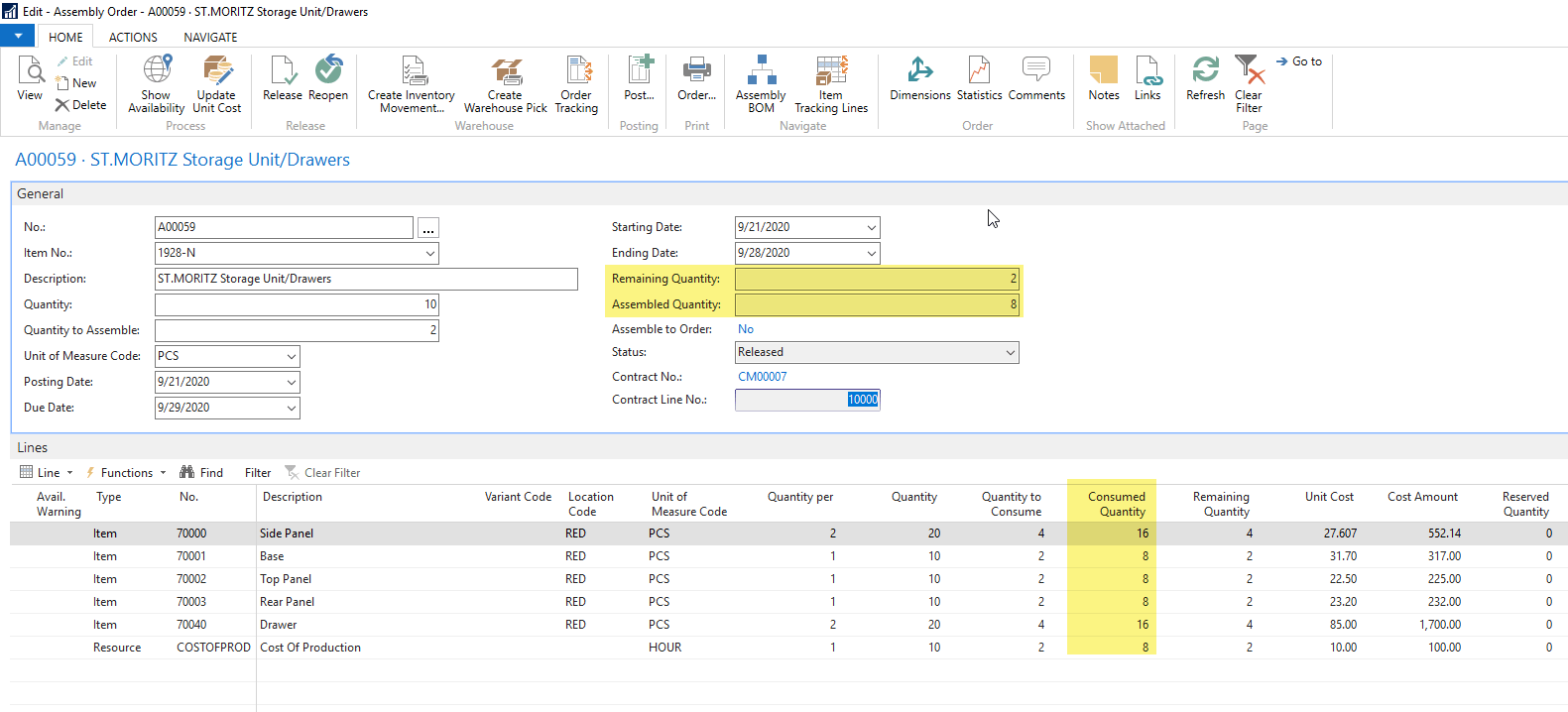

To update the production for the finished item, enter the quantity to assemble (8 in the example below) and post output. Dynamics NAV will consume the components and create output in the vendor location.

Below is the updated assembly order after posting the output.

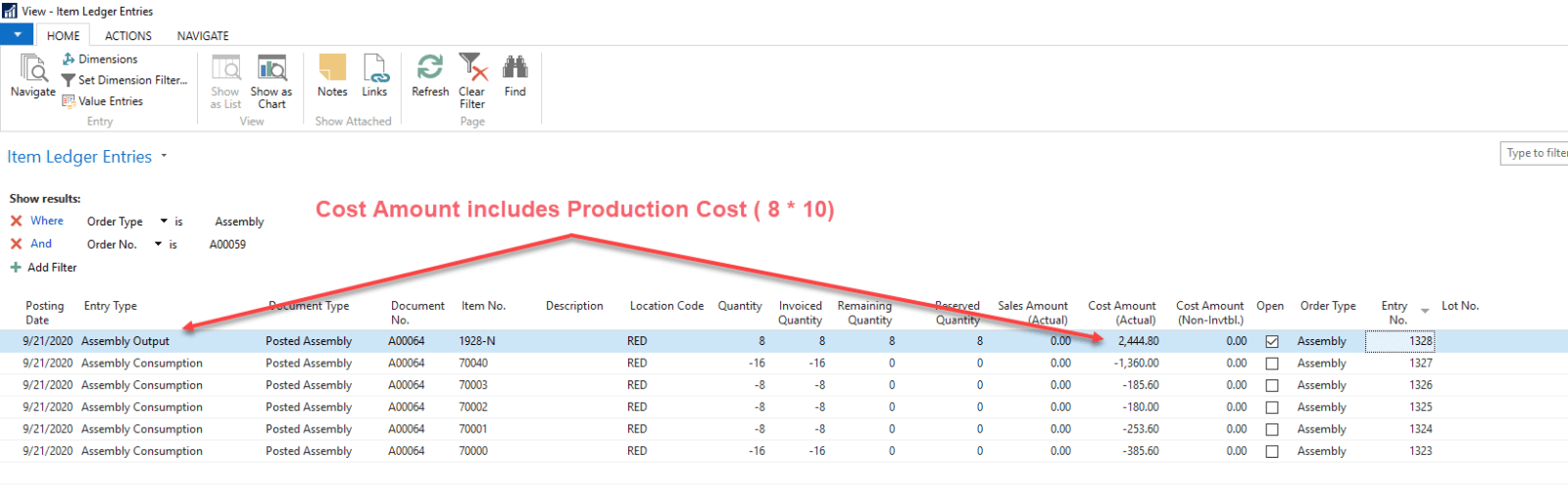

The actual cost amount in the Item Ledger Entry for Assembled Output includes the production cost

(Output Quantity * Unit Cost of Production which is $80 (8 * 10))

The cost of production is posted to an AP accrual account as a credit

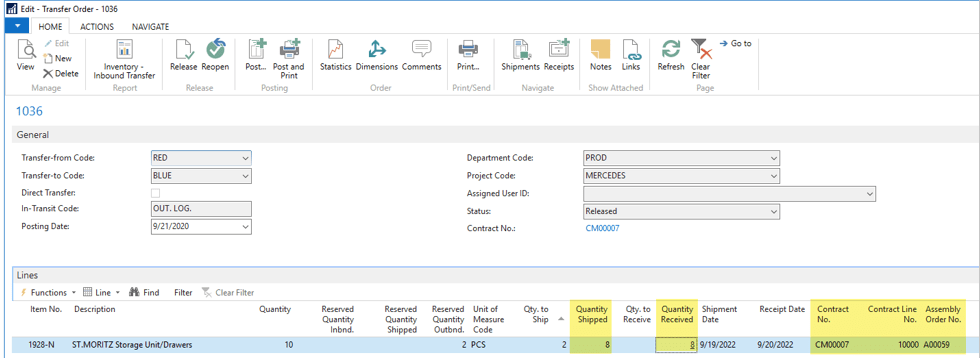

From the Contract Order Line you can open the transfer order that has been created to transfer finished production items from the vendor location to the company’s vendor location. The posting should be when the items are received at the company’s warehouse location.

In the example below, the transferred order has been posted to receive the quantity of 8 which is received at the company’s warehouse location.

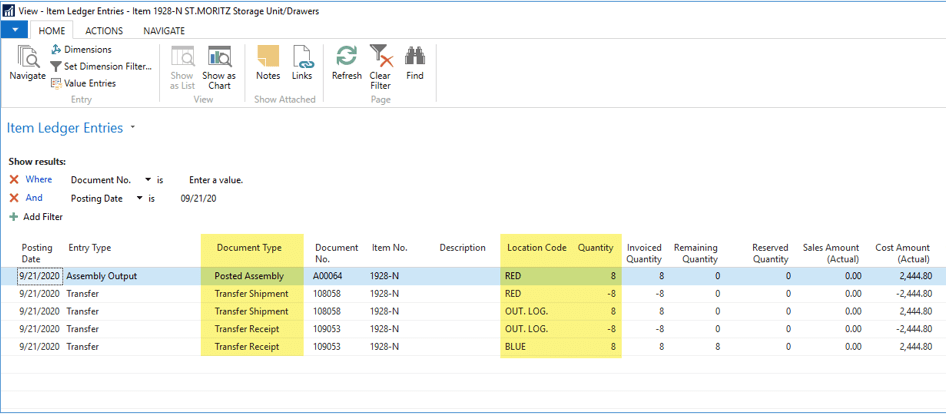

Item Ledger Entries for Item which is posted output and then transfer from Vendor Location to Company Location.

The Contract Order Line is also updated to show that a quantity of 8 has been received

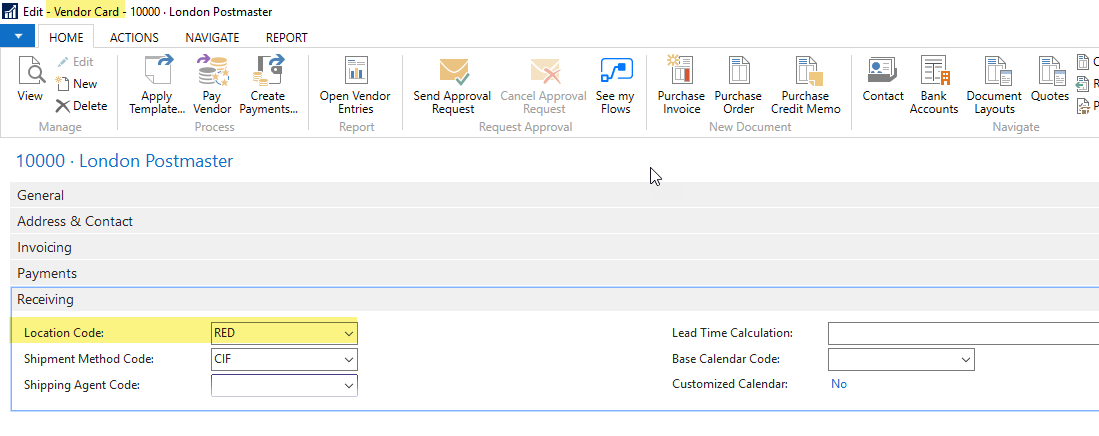

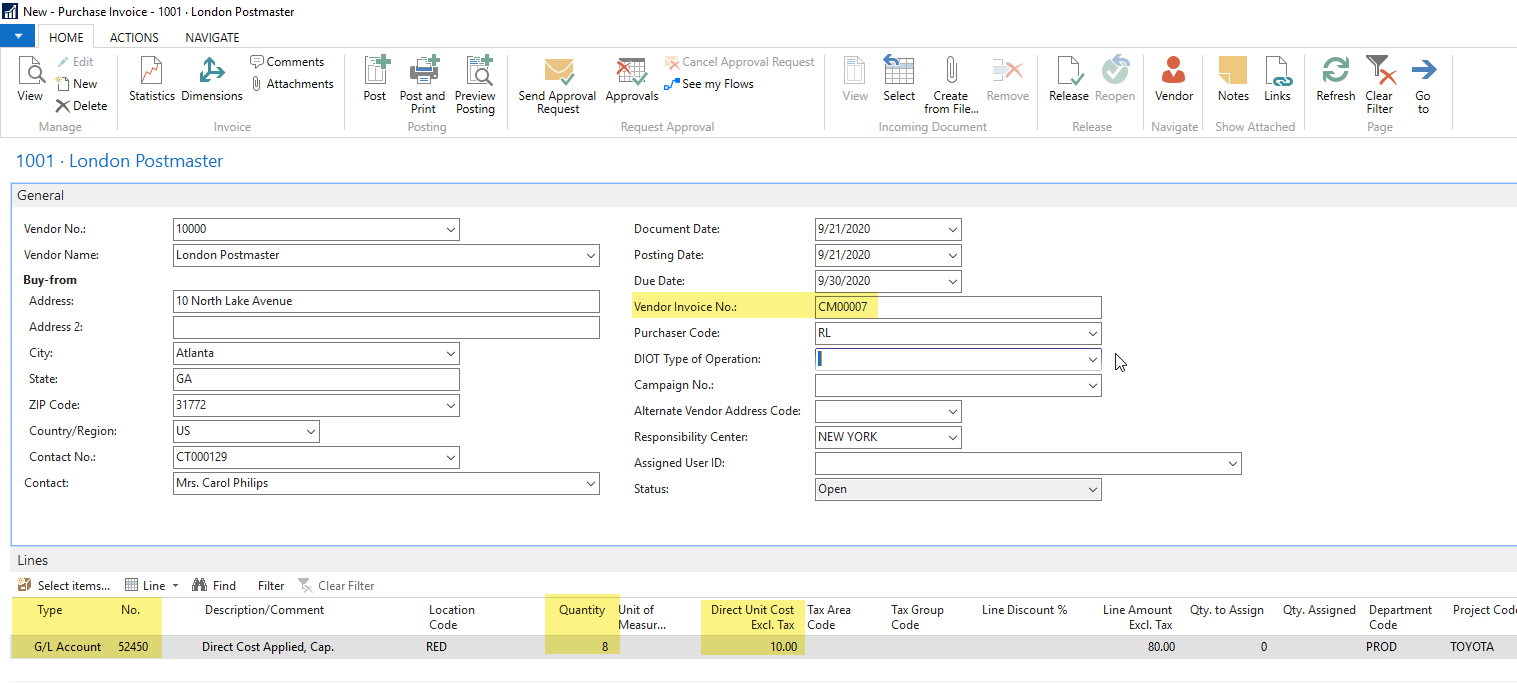

When the vendor sends an invoice to charge for items produced, create a purchase Invoice for the vendor to create a payables entry. The offset account is the AP Accrual account used for production costs.

Posted Purchase Invoice for Production Cost.